Rising U.S. National Debt Is Major Threat That’s Being Ignored

It’s astonishing that one of the biggest problems for—one could even call it a major threat to—the U.S. economy and financial world continues to get ignored: the national debt. If history is any indicator, things won’t end well.

Here’s the problem: the U.S. debt is increasing at an extremely fast pace. The past few years were troubling, but now, things are outright alarming. Between March 7 and July 27, the U.S. national debt went from about $31.5 trillion to $32.7 trillion. (Source: “Debt to the Penny,” FiscalData, last accessed August 1, 2023.)

In about 100 business days, the national debt increased by $1.2 trillion!

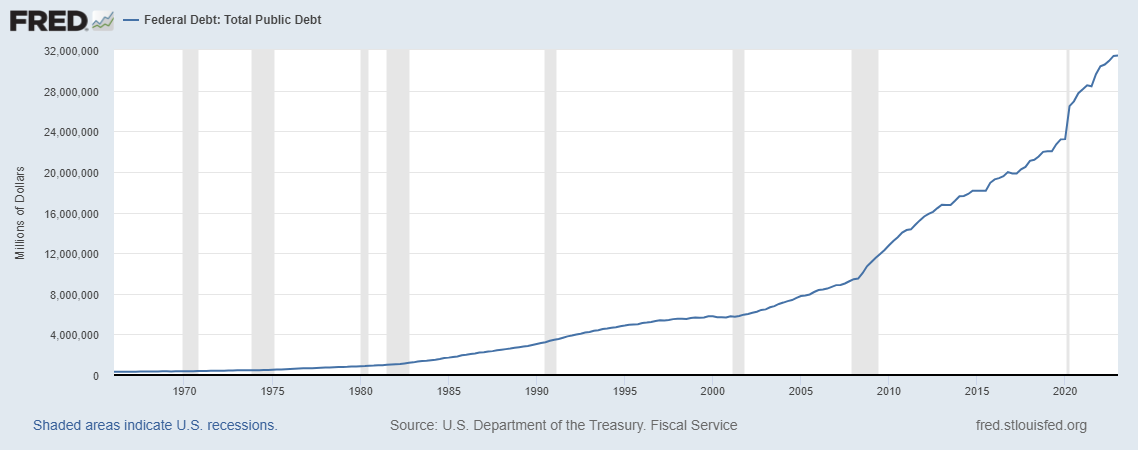

And this is just what has happened over the past few months. Take a look at the chart below to see how the U.S. debt has ballooned over the years.

At the end of the financial crisis of 2008–2009, the U.S. national debt stood at just about $12.0 trillion. Since then, it has jumped by more than 172%.

(Source: “Federal Debt: Total Public Debt,” Federal Reserve Bank of St. Louis, last accessed August 1, 2023.)

What’s Next for the National Debt?

In simple terms, the U.S. national debt is going to get a lot worse. It wouldn’t be shocking to see it soar past $40.0 trillion much sooner than previously expected.

There are two big triggers that could send the U.S. debt surging in the near term.

First, government spending is huge, and there’s really no end in sight for budget deficits. So far in fiscal year 2023, which began in October 2022, the U.S. government has already incurred a budget deficit of $1.4 trillion. (Source: “Monthly Treasury Statement,” U.S. Department of The Treasury, last accessed August 1, 2023.)

Second, the interest expense on the debt is getting bigger. For fiscal year 2023, the U.S. government is projecting that it will pay close to $900.0 billion in interest payments! Interest rates are high right now, and if they remain high for a few more quarters, don’t you think the government’s interest expense could hit $1.0 trillion?

For the long term, you can’t ignore the fact that government spending tends to run higher in times of economic slowdown. So, if a recession is nearing, will the U.S. government be able to control its spending? It’s very unlikely.

Also, over the years, we’ve heard about a retirement crisis in the U.S. Many state and municipal pension funds across the U.S. are underfunded. It’s a $6.0-trillion ticking time bomb. Will the federal government eventually save these pension funds? If yes, that could cause a spike in the U.S. national debt.

And don’t forget student debt; it’s another factor that could send the national debt higher.

What Happens When Creditors Aren’t Willing to Lend?

One of the reasons the ballooning U.S. national debt doesn’t get much attention in the mainstream press is that there’s a general consensus that the trillion-dollar figures don’t matter. We’re told that this is because the U.S. dollar is a reserve currency. This allows the U.S. to keep spending money and finding creditors.

Furthermore, the U.S. is considered a safe investment hub (it really is, compared to many other jurisdictions) and therefore, the U.S. debt is considered a safe investment.

Dear reader, in the short term, even if the national debt soars, it’s hard to see anything bad happening. It shouldn’t create any problems. The world certainly believes in investing in the U.S. national debt and the U.S. dollar. They’re quality assets.

However, you can’t take what’s happening with the U.S. debt lightly if you’re investing for the long term. It must be asked: How long will it be until the creditors of the U.S. government say, “We can’t lend you money anymore?”

When will that time come? I can’t predict. But as I said earlier, history suggests that the time will eventually come. When that moment arrives and U.S. national debt isn’t selling like hotcakes, it won’t be a pretty sight. It will take the U.S. dollar, the U.S. economy, and the stock market down with it.